An emergency fund is a savings account that's designed to help for life's unexpected emergencies. It's also a huge step toward financial peace of mind. The infographic below gives you 5 steps to creating an emergency fund.

Share this Infopgraphic On Your Site

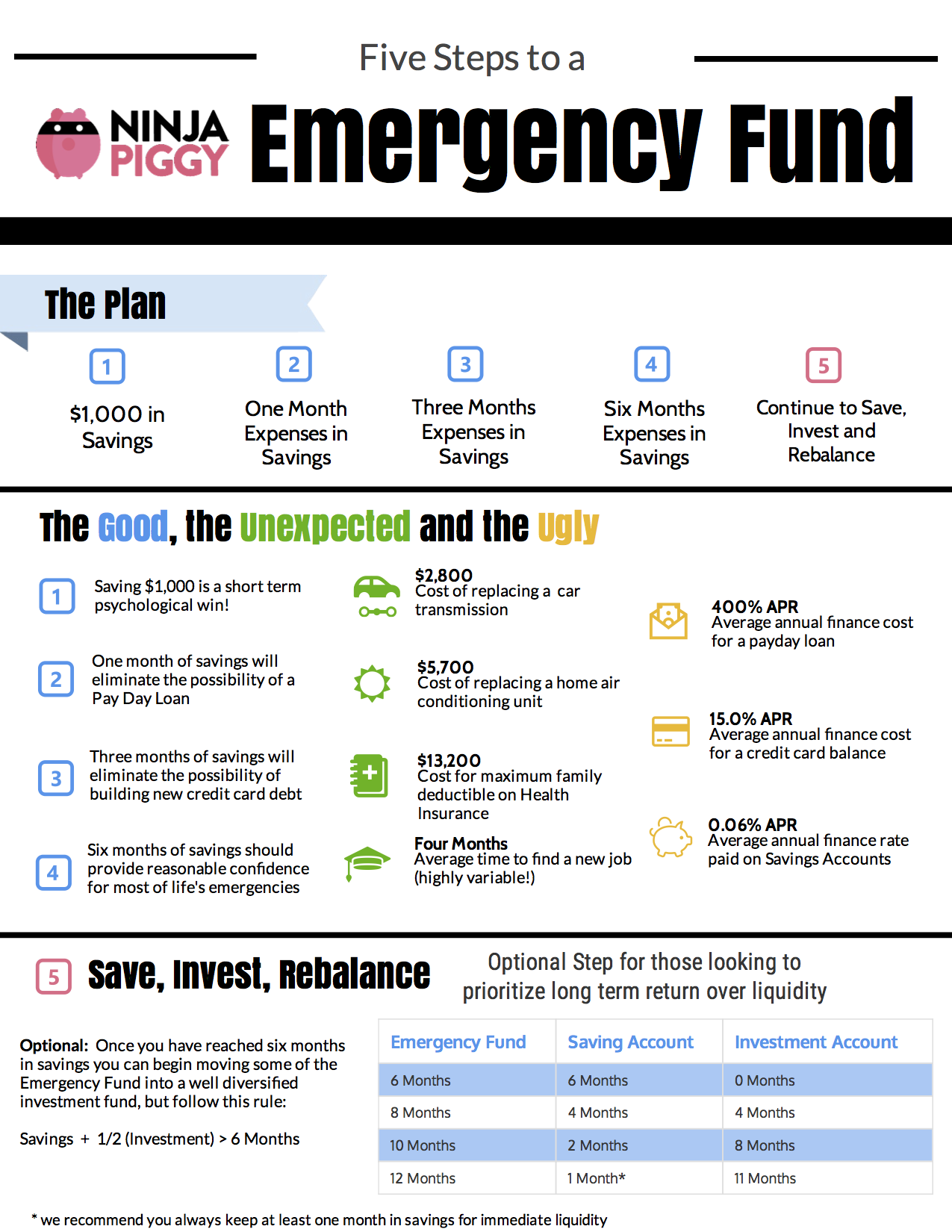

Five Steps to creating a NinjaPiggy Emergency Fund

Everybody needs to have money in savings for when an emergency hits. Saving for an emergency fund can be a long and boring process, and some people don't like the thought of having too much money sitting in a low yielding savings account. It’s easier to achieve a large goal by breaking it down into a few manageable steps. Follow the 5 step process to a fully funded emergency fund that will satisfy both the risk adverse and risk seekers:

Step 1: $1,000 in Savings

If you currently don’t have any savings, your first goal needs to be $1,000 in savings. Open a savings account that is strictly for your emergency fund. Many banks (including Ally Bank and Capital One) allow you to open an online savings account with no fees or minimums. You can typically open multiple savings accounts with online banks, if you want sub-accounts for specific reasons (vacation account, gift account, down payment savings account, etc.). Be sure to open one account that is specific for emergencies. Focus on getting to $1,000 as quickly as possible.

Step 2: $3,000 or 1 Month Expenses in Savings

After you’ve reached $1,000 in your savings account, your next goal should be to increase the value of your savings account to $3,000 or 1 month expenses (whichever is greater). Achieving this savings benchmark will give you the peace of mind that, if you happen to lose your job, you at least have a little breathing room.

Step 3: Three Months Expenses in Savings

Going from $3,000, to having 3 months expenses in savings can be a bit of grind. It may take a little longer to complete step 3 compared to steps one and two, but it is well worth the effort. Having 3 months in savings means that you are well prepared to handle life’s emergencies. If you lose your job, you won’t be forced to take the first job that comes along. You’ll also be more prepared financially to handle a major medical emergency.

Step 4: Six Months Expenses in Savings

Plenty of financial advice states you should have 3 months expenses set aside an emergency account. I don't think you should stop there. Part of the process of step 4 is continuing to build on the good savings habits you’ve developed in steps 1-3. At this stage, you should still be putting the money aside in a savings account (I know it’s boring but for you risk seekers, there is hope ahead at step 5).

Step 5: Continue to Save and Invest

Once you’ve reached 6 months expenses in savings you’re done right? Nope, that’s where the fun begins. Many people think having 6 months expenses in a savings account is dumb, and they would rather be investing a portion of the money in something that has higher return potential. When you’ve reached step 5, you’ve demonstrated a disciplined ability and willingness to save, so pat yourself on the back.

While I believe everyone should strictly follow steps 1-4, step 5 allows for leeway depending on your thoughts and attitudes toward risk. Remember, personal finances is personal. You have a couple of options for your ongoing saving/ investment money:

Option 1:

Leave the 6 months worth of expenses in a savings account and start investing the additional money you have going forward. The investing would be done is a separate brokerage account. Option 1 is the conservative option for those of you that don’t want to take any risk with their emergency fund.

Option 2:

If you’re the type that doesn’t like having so much in a savings account, then option 2 is for you. At step 5, you have 6 months of expenses saved and you are ready to continue to build on that amount.

Any time you invest in a diversified portfolio stocks you should be prepared to lose 50% of that money. Using that logic, if you have 2 months worth of expenses invested in stocks, you should be prepared for that to be halved into one month worth of expenses. Once you reach the 6 month worth of expenses saved threshold (step 4), you can start putting all of your additional money into stocks. In addition, you can start slowly moving your emergency fund money that is sitting in savings using the 50% potential loss rule. The rules works as follows:

Let’s say you have 7 months worth of expenses in savings and you want to start investing the money. You can take 2 months worth of expenses and invest the money in a diversified stock portfolio. That would leave you with 5 months worth of expenses sitting in savings, and 2 months invested. Since you could lose 50% of the value invested in stocks you take half of the 2 months, and treat it as only 1 month, for a total of 6 months (5 months + 1 month) The key is to always have at least 6 months of expenses accounted for through a combination of savings and investing.

Once you have a full year of expenses in savings, you could feasibly invest 100% of your emergency fund in the stock market, if you choose. That is because if you lose half of the value of 12 months worth of expenses, you still have 6 months worth of expenses.

Whatever you do, don’t get complacent and stop saving when you get to step 5. Make saving and investing a consistent part of your financial plan going forward. Follow the steps in order. No taking shortcuts. Don’t start investing any of your emergency fund until you reach step 5. There are many benefits to having an emergency fund. Take the time to do it right, and follow the five steps.